BTC/LTC Price Increase Article

After weeks and weeks of price drops as low as $275, a price unseen since the explosive rise in November last year, going up 24% from ~$350 all the way to a peak of $434 on BTC-e after falling back to the mid $410s. As well as a massive Bitcoin increase today, we have also seen a Litecoin rise of about 12% peaking at about $4.15 before falling again back to just under $4.

One possibility for this price pump could have been sparked by large investor Raoul Pal of Global Macro Investor Group making a wide claim earlier this week that Bitcoin will hit $1,000,000 based on its current supply as compared to the supply of gold. Pal states, “One Bitcoin should theoretically be worth 700 ounces of gold or pretty close to $1,000,000, if we adjust existing supply of both to equal each other”. Which makes sense as both gold and BTC deal with finite quantities, and gain value as time goes on due to deflation.

Some believe that the explosive rise that Bitcoin experienced late November last year where the price rose by ~1100% will be reciprocated this year, so buyers are getting in now to prepare for the expected rise. Another potential reason for this rise is that people are buying into BTC to buy products on Black Friday at online retailers such as NewEgg with huge discounts.

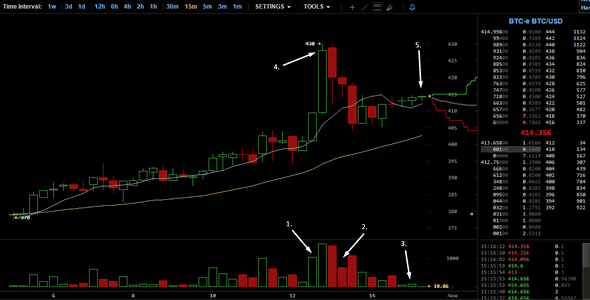

Today’s BTC afternoon trading can be broken down into a few main parts

- The first wave of initial pumping occurs with very high volume.

- Shortly after the wave of buys, a similar volume of sells occurred crashing down the price back to the mid $410 range,

- The volume levels out and the price recovers back to 50% of the pump.

- Today’s peak was a new high at around $430 ($434 on BitStamp)

- the price goes back up to the mid $410s and stabilizes with lower trade volume.

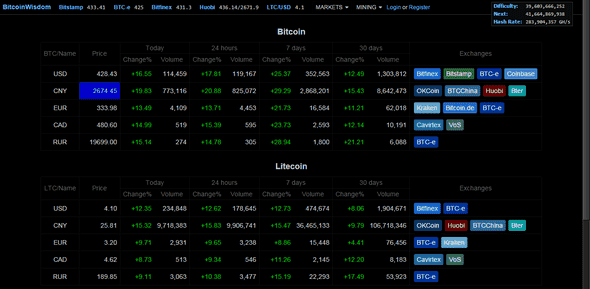

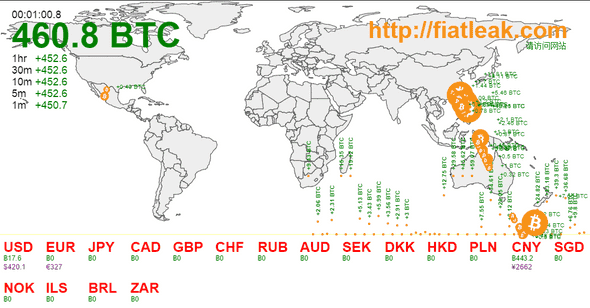

It appears that Chinese markets are driving this upward rise with volumes of almost 6x the USD volume in BTC and over 56x the usd volume for LTC. Today’s volume numbers were extremely high as compared to recent days this week: 40% of this weeks volume was done today in USD and 31% in the Chinese Yuan.

In just five minutes, CNY/BTC had 25x volume than the next largest market with USD/BTC.

With these major fluctuations today, many exchanges had very large price gaps, a perfect opportunity for some profitable arbitrage to take place. After the initial rise, BTC-e dropped down under $410 the first while other exchanges such as Bitstamp stayed above $425, perfect for a few quick trades and a large % of profit.

The concern at this point is whether there is sufficient support at these price levels, or if we will experience another dump crashing the price back down to the 300’s.

Written by Taylan Unal (Edited slightly)